The metaverse is one of the hottest buzzwords in tech, and this far-reaching vision of a next-gen internet will rely upon an entire ecosystem of companies to make it a reality. We cut through the noise to explain what the metaverse is, how it’s being built, and who’s building it.

WHERE IS THIS DATA COMING FROM?

Start your free trial todayEmail

The business world is obsessed with “the metaverse”: the concept of shared worlds driven by virtual products and digital experiences that are highly immersive and interactive.

We already have virtual worlds featuring live concerts and online games where players spend hundreds of hours — but metaverse enthusiasts see a future where entire societies thrive in an online realm inhabited by avatars of real people.

While the space is still in early days, the longer-term implications may not be trivial. Some users — especially younger ones — may eventually earn, spend, and invest most of their money in digital worlds. The metaverse could represent a $1T market by the end of the decade, according to CB Insights’ Industry Analyst Consensus.

This dollar potential has caught the attention of players across industries. Facebook rebranded to “Meta” late last year, and earnings call mentions of the metaverse rose 4x year-over-year in Q4’21. Media discussion surrounding the topic has similarly surged, as news outlets have speculated whether the metaverse — and the emergence of full-fledged virtual economies, complete with property ownership, corporate offices, fashion seasons, and more — is poised to become the next big thing in tech, or if it’s hugely overhyped.

The metaverse is a vision, not a specific technology. For enterprises, this ambiguity can make it challenging to figure out how to tap into the emerging trends the metaverse represents.

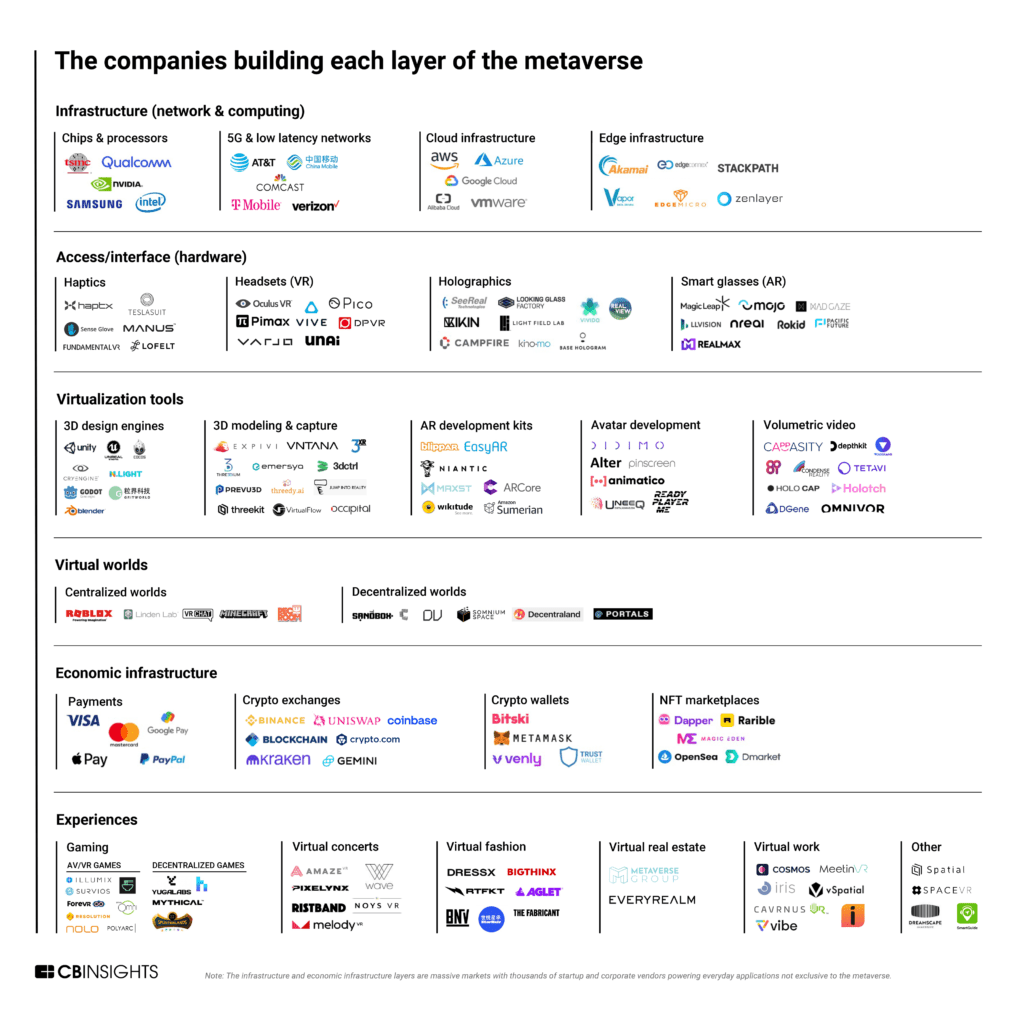

Below, we provide a framework to navigate this evolving topic by breaking down the metaverse into distinct technological layers and highlighting the key vendors set on making the metaverse a reality.

Note: Vendors are selected based on a wide range of criteria — including funding, business relationships, prominence in the market, and CB Insights proprietary Mosaic Scores. This market map is not intended to be exhaustive of the space. Categories are not mutually exclusive, and companies are sorted by primary use case.

This report focuses on private companies, but a few select subsidiaries, exited companies, and public company platforms are included to provide market context.

Infrastructure (network & computing)

The metaverse requires compute and processing infrastructure that can support both big data flows and low latency. Tech emerging within categories such as chips & processors, 5G, cloud infrastructure, and edge infrastructure, will prove vital to creating a seamless, lag-free experience in the metaverse.

Chips & processors: Advancements in this space will support the intense computing and processing requirements of metaverse applications.

New metaverse-focused hardware — e.g., virtual reality (VR) headsets and augmented reality (AR) glasses — is being designed to support intense workloads related to high-fidelity graphics and artificial intelligence (AI) on smaller, lightweight devices. Qualcomm chips stand out in this arena — the tech giant claims its Snapdragon chips have been used in over 50 AR/VR devices, including popular VR headsets like Meta’s Oculus and HTC Vive. Qualcomm also recently announced the launch of its $100M Snapdragon Metaverse Fund, which will invest in the extended reality (XR) space.

Additionally, Intel claims that the metaverse will necessitate a 1000x increase in computational efficiency, including advancements in 5G and hybrid edge-cloud infrastructures. That said, new chips will also be required to power these critical low latency computing networks. In February 2022, the semiconductor company released details on new chips that will support high-power data centers and 5G networks.

5G & low latency networks: 5G wireless tech will power high-resolution metaverse applications — such as immersive worlds or gaming — by supporting reliable, flexible, and low latency networks for connected devices.

As of 2022, each of the leading telecom companies in the US offers a 5G network. Some are experimenting with 5G in gaming and AR/VR. For example, in April 2021, Verizon partnered with VR startup Dreamscape Immersive to build immersive learning and training applications on Verizon’s 5G network. Three months later, AT&T partnered with Meta’s Reality Labs to show how 5G could be utilized to generate more seamless augmented reality experiences.

Cloud infrastructure: Cloud infrastructure will enable metaverse companies, especially those hosting virtual worlds and experiences, to store and parse through the vast amounts of data they generate.

In 2018, Epic Games‘ Fortnite generated 5 petabytes of data per month (that’s equivalent to 2.5T pages of standard text). In order to store and make sense of this data, Fortnite runsalmost entirely on Amazon Web Services (AWS), where it uses cloud computing to aggregate and analyze information from its otherwise unwieldy data stream.

Advancements in this space will also help people access the metaverse on devices that lack sufficient processing power for applications like high-res graphics and AI — cloud computing allows experiences to be processed on a remote server and then streamed to a device, such as a PC, VR headset, or phone. While this back-and-forth communication with an external server can lag, related developments in edge computing and 5G will help to reduce latency.

Edge infrastructure: Edge computing will be used for metaverse applications that depend on real-time responses, such as AR/VR and gaming.

Edge computing enables data from low-power devices to be processed closer to where it is created — i.e., at “the edge.” This can be particularly helpful when it comes to situations that require information to be processed in real time — such as utilizing hand-tracking sensors on a VR headset or processing commands during competitive gaming. In fact, edge infrastructure companies like Stackpath and Zenlayer list gaming and virtual reality among their main focus areas.

Edge processing is heavily interrelated with cloud computing. While cloud infrastructure handles workloads that do not require minimal latency, such as loading out-of-sight objects in a game, edge infrastructure handles inputs that need a very quick response, like player movements. Some companies develop blended offerings. For example, Akamai offers edge-cloud hybrid services to a number of high-profile gaming companies, including Roblox and unicorn Riot Games.

Access/interface (hardware)

This layer includes hardware devices that allow people to experience the metaverse. While this category encompasses connected devices like mobile phones, PCs, and gaming consoles, it is predominantly centered around emerging technologies designed to enhance immersion in a virtual setting.

Haptics: Haptic startups are developing technology to bring the sense of touch into virtual worlds.

Some startups, such as HaptX and Sense Glove, are developing gloves that grant virtual objects tangibility. Bridging micro-vibrations, pneumatic systems for force resistance, and motion tracking, this technology can give the impression that digital objects have texture, stiffness, and weight.

In the future, haptic technology may extend well beyond a person’s hands. Scotland-based Teslasuit is developing complete bodysuits to provide whole-body haptic feedback and climate control in virtual environments.

Headsets (VR): These companies are developing VR goggles — currently considered the main entry point to metaverse applications. These devices provide visual and audio content to users to immerse them in a digital setting.

One of the most popular VR headsets is Meta’s Oculus, which saw a surge in consumer interest during the 2021 holiday season.

Startups have followed suit. Varjo, for example, uses lidar and computer vision to bring depth perception, eye-tracking, and hand-tracking to its VR headsets.

Holographics: These companies use light diffraction technology to project 3D objects into physical spaces. These holograms, like augmented reality, bring digital experiences into the physical world.

While holographic technology is still in its early stages, it has the potential to be applied to a wide range of use cases, from hologram-led set design and performances to product design and medicine. Base Hologram is using the tech to bring popular artists like Whitney Houston and Buddy Holly back to the stage, while Israel-based RealView Imaging renders holograms of a patient’s internal organs to help with surgical planning.

The technology has a long way to go before it sees widespread success, but companies currently working in the space have given us an idea of what to expect down the road.

Smart glasses (AR): Companies here are developing glasses or contact lenses with AR capabilities.

While not all applications of AR glasses are directly related to the metaverse — for example, AR tools designed exclusively to help engineers fix refrigerators do not revolve around shared experiences — the companies featured in this category are setting the foundation for a bridge between physical and virtual worlds.

As AR gains popularity, particularly for social purposes, the tech will evolve into a tool that more effectively blends virtual and real-world elements — such as interacting with someone’s metaverse avatar at an event — further blurring the line between consumers’ online and offline identities.

Currently, China-based Nreal is developing AR glasses equipped with web browsing and video streaming capabilities for the everyday consumer. Others, like Magic Leap, are developing AR headsets for enterprise use cases.

Virtualization tools

These companies are working on software development kits, game engines, 3D scanning technology, and other developer tools to help 3D content designers build metaverse worlds and experiences.

3D design engines: Companies in this category provide tools like game engines and animated visual effects that designers can use to build the visual elements of the metaverse.

For example, Epic Games’ Unreal Engine is used to develop its internal suite of games, such as Rocket League and Fortnite. It’s also the backbone of a host of high-profile games made by other studios.

Unreal Engine and its competitor Unity are also used by AR/VR developers — Unreal has been used by VR game studios Survios and Sanzaru, while the popular VR game Beat Saber was designed using Unity.

3D modeling & capture: Companies in this category help brands capture and create 3D representations of physical products or environments. This tech is becoming popular among e-commerce platforms looking to help consumers better understand their products. However, it could soon be adopted by companies looking to quickly create metaverse versions of real-life products.

For example, Vntana uses 3D scanning to transform products like furniture or jewelry into 3D images. From there, these products can be uploaded to e-commerce websites, social media, or augmented reality where users can access 360° views of products, shift colors and textures, and test how products might look in real-world spaces.

Other companies use scanning and 3D capture to translate physical environments into virtual ones. For example, PreVu3D creates virtual models of factories. These are currently used to help redesign layouts for the sake of efficiency, but the underlying tech could also be employed to build out metaverse experiences.

AR developer kits: These companies provide software development kits (SDKs) to optimize AR app development. Most startups in this category are early stage, as AR has yet to permeate into mainstream use cases.

In 2021, Pokémon GO creator Niantic announced the launch of its AR developer platform, Lightship, as it is looking to expand beyond its identity as a pure AR gaming company. In September 2021, Qualcomm acquired Austria-based Wikitude, a startup building SDKs to speed up AR app design. This acquisition likely served as the foundation for the development of Qualcomm’s head-worn AR developer kit, which launched 2 months after the acquisition.

Qualcomm is not the only incumbent tech player in this space. Startups will likely face competition from tech giant products like Amazon Sumerian, Google ARCore, and Meta’s Presence Platform.

Avatar development: Avatar development startups are helping individuals, games, and brands design custom, lifelike avatars that metaverse users can embody and engage.

Startups like Alter and Ready Player Me allow users to transform selfies into cartoon-like avatars that can be customized in thousands of ways. These companies also want their avatars to be interoperable across the metaverse, in order to allow users to maintain a singular identity as they flit across virtual worlds and experiences.

Other startups are more focused on hyper-realistic avatars, including those for corporate use cases. For example, Pinscreen and Uneeq offer avatar development platforms that incorporate natural language processing (NLP) tools — AI capable of understanding and replying to human language in an intelligent manner — so that brands and corporations can create virtual assistant avatars for customer service.

Volumetric video: Volumetric video companies capture videos of real-world experiences from multiple perspectives so that they can be viewed in 3D in digital environments.

Volumetric video is set to play a key role in bringing entertainment to the metaverse. Israel-based Tetavi, for example, is using volumetric video to create media, gaming, and other VR-based content. The startup claims it is currently in discussions with major artists and production companies — that said, it likely wants to use its technology to live stream concerts, dance performances, and more to a virtual stage.

Virtual worlds

Virtual worlds are where people will congregate and exist in the metaverse, and these worlds will be characterized by their user-driven experiences and economies.

Centralized worlds: In a centralized virtual world, a single company has the ultimate say over the world’s rules, goods, and experiences. Other than that, it is typically a socially-driven environment where people can congregate and use interactive tools.

Roblox, for instance, comes with its own developer portal that enables users to create custom landscapes, items, minigames, and more. This freedom is key to the Roblox world’s value proposition. The fact that users are empowered to create scenarios ranging from deepsea diving to daring prison escapes helps drive a flywheel effect that will be central to growing metaverse worlds — dedicated users will improve a virtual world, attracting more users who will, in turn, improve the experience for others.

Creators can also charge for their services. While centralized virtual worlds will take a percentage of creator earnings (Roblox takes about 27 cents on the dollar), some creators have seen great success. In 2006, a creator in the virtual world Second Life, Anshe Chung, is believed to have become the first person to achieve real-world millionaire status from a business built in a virtual world.

While Roblox and Second Life are accessed on traditional gaming consoles like Xbox, Playstation, PCs, and smartphones, startups like VRChat and Rec Room are looking to create more immersive virtual worlds by moving beyond screenplay to incorporate VR capabilities.

Decentralized worlds: Decentralized virtual worlds provide similar experiences to virtual worlds. However, these worlds are built using blockchain tech.

Decentraland and The Sandbox are two of the most popular decentralized worlds. Just like their centralized counterparts, these worlds allow inhabitants to buy, sell, and create. However, these transactions are all based on each world’s unique cryptocurrency. Furthermore, in-world items or land are traded as NFTs, which act as decentralized proof-of-ownership certificates for digital assets.

Since developers won’t be ceding control to another single entity that controls a standard, some are betting that the decentralized aspect of blockchain will boost interoperability between games and other platforms. This would ultimately allow for a scarcity of assets to be enforced across worlds. In the future, a person may be able to “move” their NFT yacht from one decentralized world to another.

Decentralized worlds also tend to use a different business model than their centralized counterparts — they generate revenue from the sale of virtual land, crypto, and other digital assets as opposed to taking a percentage of the profit generated by in-world creators.

Some decentralized virtual worlds even let their inhabitants help govern via a decentralized autonomous organization (DAO) approach. These setups — backed by blockchain-based, auto-enforceable “smart contracts” — typically grant users voting rights proportional to the in-world crypto assets they own, allowing them to have a say on in-world rules and regulations.

Economic infrastructure

This layer includes the tech that will enable people to buy, sell, and store goods and services in the metaverse.

Despite the surge of interest around crypto and NFTs, startups and companies entering this space will likely only serve a small part of the metaverse — the decentralized metaverse. As a result, traditional payments companies will remain highly relevant. After all, if the metaverse were exclusively run on decentralized finance, companies would lose out on a massive opportunity to service non-crypto-carrying customers.

Payments: Traditional payment methods will not be obsolete in the metaverse. As economies in virtual worlds grow, customers will want to use their typical payments systems out of convenience, and providers will be eager to grab a slice of these transactions.

PayPal can be already used to buy virtual currencies in Roblox, Minecraft, and Second Life. Meanwhile, Minecraft accepts a number of payment methods for its in-world currency, Minecoin, including Visa, Google Pay, Apple Pay, and Mastercard.

Crypto exchanges: These companies offer platforms for buying and selling crypto, including the cryptocurrencies native to decentralized digital worlds.

For example, The Sandbox’s cryptocurrency, Sand, can be traded on exchanges like Gemini, Crypto.com, and Binance. Similarly, MANA, the cryptocurrency native to Decentraland, can be purchased on Coinbase, Kraken, and others.

Crypto wallets: Crypto wallets act as login credentials for decentralized worlds.

In order to sign into a world like Cryptovoxels or Decentraland, a user needs to have a crypto wallet. The wallet’s unique ID allows it to function as a user’s personal account. As long as they have access to the wallet, they can log into decentralized worlds from multiple devices and receive digital assets such as in-world currency or NFTs of virtual land.

Sandbox, for instance, allows users to sign up with some of the most popular crypto wallets, including Venly, Bitski, and Metamask.

NFT marketplaces: These startups are supporting commerce in decentralized worlds by developing platforms where users can buy and sell NFTs of everything from virtual land to avatar clothing to virtual yachts.

Non-fungible tokens (NFTs) are not exclusively a metaverse concept — people can buy and sell NFTs of tweets, videos, and more without ever participating in the metaverse. However, NFTs are emerging as the backbone of economic activity in decentralized virtual worlds given that they provide proof of ownership for metaverse-based property.

NFTs for metaverse items can also be listed on external NFT marketplaces. For example, marketplaces like Open Sea or Rarible already support the sale of virtual real estate and items from Decentraland and The Sandbox. Similarly, startups like DMarket are developing NFT marketplaces specifically catered to trading goods for decentralized worlds and games.

Experiences

This layer covers the various goods, services, and experiences that will be available in the metaverse. Note that this layer will continue to evolve and change — the featured categories below illustrate some of the metaverse experiences that are gaining traction at present.

Gaming: This category includes AR/VR gaming companies as well as companies developing decentralized multiplayer games. While the metaverse could incorporate traditional games, the categories highlighted below instead discuss emerging gaming trends that could influence the evolution of the metaverse.

AR/VR games

These startups are ushering in the next wave of immersive AR/VR gaming.

Most featured companies, such as Ramen VR, Survios, and ForeVR Games, are VR-focused game studios. Others, like Disney-backed Illumix, are developing AR games that can transform your smartphone camera into a gaming platform. Illumix’s critically acclaimed horror game, Five Nights At Freddy’s, allows users to fight off and collect possessed animatronics hiding in the walls of their homes.

Decentralized games

These startups are blockchain-based, multiplayer games or startups helping gaming companies develop blockchain-based games. Decentralized games are similar to decentralized virtual worlds, but they are not quite as extensive in terms of player freedom.

For example, Mythical Games’ decentralized game, Blankos, allows players to build minigames and trade NFT items. However, players can’t create new textures, creatures, or items like they can in Roblox or Second Life. Additionally, the games’ rules are not determined by a DAO, as is the case with Decentraland or The Sandbox.

Virtual concerts: These startups are building virtual concert venues in the metaverse, and they are also enhancing in-person concerts with new immersive experiences.

For example, in January 2022, AmazeVR drew $15M in Series B funding for its VR concert platform.

Companies in this category may find themselves facing competition from virtual world and gaming companies — Fortnite’s Travis Scott concert, for example, was attended by over 12M viewers.

Other startups are getting creative by using augmented reality to enhance in-person concerts. Pixelynx, a company founded by musicians including deadmau5, is using AR to gamify concerts. Fans can point their phones at the stage and experience new visuals, participate in minigames, and collect virtual items and NFTs.

Virtual fashion: Virtual fashion companies are brands developing clothing to be worn in the metaverse.

Virtual fashion startups are still in early stages of development. Brand New Vision and DressX recently raised seed rounds to support their NFT-based fashion items. Users who purchase from these startups will have the option to use AR to show off their virtual outfits, which can range from relatively regular-looking jackets to elaborate dresses that would be hard to manufacture in the physical world.

Larger fashion brands are also eyeing virtual fashion as a way to market themselves and build new revenue streams. Nike, for instance, acquired virtual sneaker company RTFKT, and partnered with Roblox to build “Nikeland” — a world where users can buy Nike outfits for their avatars. Similarly, Balenciaga released virtual fashion brands in Fortnite, and a digital Gucci “bag” sold for over $4,000 on Roblox in May 2021.

Virtual real estate: Virtual real estate companies are buying, reselling, developing, and renting virtual properties in decentralized virtual worlds.

This is how the aforementioned Anshe Chung made millions — by buying virtual real estate, redeveloping it with Second Life’s creator tools, and renting it out to other Second Life inhabitants.

Virtual real estate company Everyrealm, a spinout of Republic Realm, made headlines when it purchased $4M worth of property in The Sandbox. One of the startup’s projects includes developing tropical landscapes on the land, which come with unique items and NFTs like megayachts (the largest of which sold for $650,000).

Virtual work: These companies are developing immersive workspaces where employees can collaborate on projects, move around digital offices, and interact with each other as if they were in the same room.

Many companies in this space rely heavily on augmented and virtual reality tech. For example, Immersed and vSpatial are developing VR office spaces where avatars can collaborate on shared whiteboards in real time, build complex workstations with several dashboards that would be impractical to set up in real life, conduct meetings, and more. Other startups are focusing on specific use cases. For example, IrisVR is developing VR spaces for architects to collaborate on projects, allowing them to interface and explore 3D renderings of structures in a shared virtual setting.

Other companies, like Cosmos Video, are more focused on amplifying the social aspect of work. The London-based startup allows workers to navigate video game-style representations of their offices, where they can host video conferences, office hours, or challenge each other to minigames.

Other: In addition to the applications above, there are a number of companies developing unique metaverse experiences.

Smartguide, for example, is building an AR app that transforms a person’s phone into a tour guide for museums. Spatial, meanwhile, raised a $25M Series B to pivot away from virtual workspaces and develop VR-based galleries where people can showcase NFT art.

Quelle: